Reclassification of loans repayable on demand

Keywords: Mazars, Thailand, Accounting, TAS, FAP, Loans, Repayable on Demand, Liabilities

21 August 2017

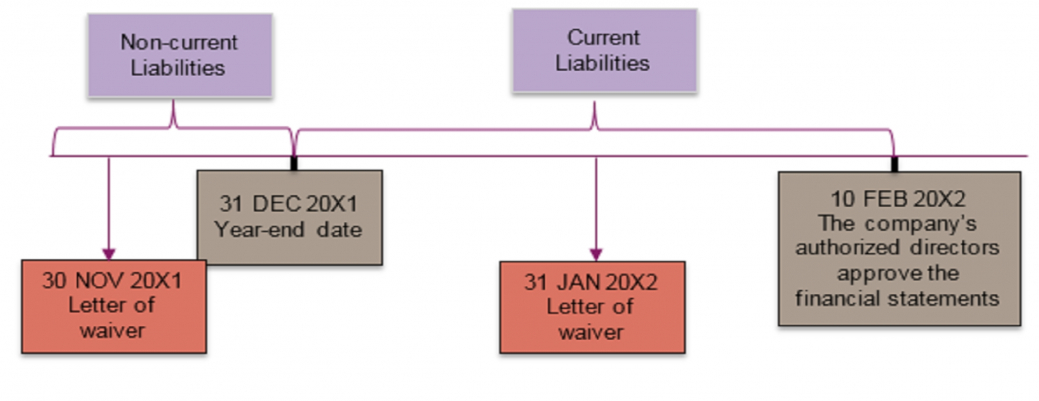

If the company is able to negotiate with the lender and postpone repayment of the loan, or if, before the end of the reporting period. The company receives a letter of waiver stating that the lender will not demand repayment of the loan for at least the next 12 months, should the company reclassify these long-term loans that are liabilities to be paid back on demand from current liabilities to non-current liabilities as at 31 December 20X1?

Paragraph 75 of TAS 1 (revised 2016) states that if, before the end of the reporting period, the lender agrees to waive the loan for at least 12 months from the end of the reporting period, long-term loans that are liabilities to be paid back on demand should continue to be classified as non-current liabilities as at 31 December 20X1, and can be paid back over a period of more than 1 year from that date.

On the other hand, if the company receives a letter of waiver after the end of the reporting period, but before the authorized directors approve the financial statements, then the following would apply.

Paragraph 74 of the Thai Accounting Standards (TAS) 1 (revised 2016) states that, if the company does not receive a letter of waiver, or if it receives a letter of waiver after the end of the reporting period, but before the authorized directors approve the financial statements, long-term loans that are liabilities to be paid back on demand must be reclassified from non-current liabilities to current liabilities as at 31 December 20X1, and must be paid back within 1 year of that date.

For more information, please visit the FAP website.