TFRS 16 Leases

Keywords: Mazars, Thailand, Leases, Accounting, FAP, Government Gazette, TFRS 16, TAS 17, IFRS 16

For further reading also see our A Closer Look at IFRS 16 and our study on the implementation of IFRS 16.

The possible effects of this standard on the financial position and performance of an entity that is a lessee are as follows:

- Accounting treatment

When this standard is announced and applied, TAS 17, ‘Leases’, will be cancelled. There will no longer be a requirement to identify the type and classification of lease and the appropriate accounting treatment thereof, such as financial leases versus operating leases. The new standard provides only a single lessee accounting model, requiring lessees to recognize assets and liabilities for all leases.

New accounting treatment required by lessees

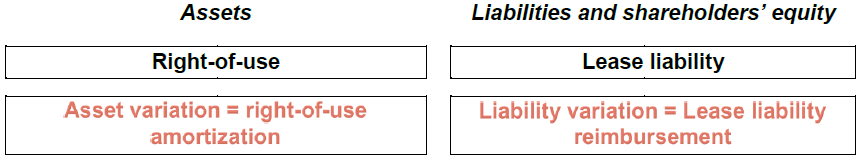

Upon commencement of a lease, the lessee should recognize a right-of-use asset and a corresponding liability.

Right-of-use assets are initially measured at the amount of the lease liability plus any initial direct costs incurred by the lessee. Adjustments may also be required for lease incentives, payments at or prior to commencement, and restoration obligations or similar items.

After commencement of the lease, the lessee shall measure the right-of-use asset using a cost model. Under the cost model, a right-of-use asset is measured at cost less accumulated depreciation and, where necessary, accumulated impairment.

As a result of this new standard, it is probable that companies balance sheets will grow, gearing ratios will increase, and capital ratios will decrease. There will also be a change in the presentation and nature of the related expense. For example, rent expenses will be replaced by depreciation and interest expenses.

However, there are recognition exemptions, as set out below:

A lessee may choose to account for lease payments as income statement expenses on a straight-line basis over the lease term or another systematic basis, for the following two types of leases:

1. Leases with a term of 12 months or less, and containing no purchase option – this choice depends on the type of underlying assets; and

2. Leases where the underlying asset has a low value when new (such as a computer or items of office furniture) – this choice can be made on a lease-by-lease basis.

The probable effect of TFRS 16 on a lessee’s balance sheet:

Account | TAS 17 | TFRS 16 | |

Finance lease | Operating lease | All lease contracts | |

Assets | Assets under finance leases | - | Assets related to lease contracts |

Liabilities | Liabilities under a finance lease agreement | - | Liabilities related to lease contracts |

Off-balance-sheet rights / obligations | - | Right-of-use assets and liabilities related to lease contracts | No longer allowed |

The probable effect of TFRS 16 on a lessee’s income statement TAS

TAS 17 | TFRS 16 | ||

Finance lease | Operating lease | All lease contracts | |

Sales and administrative expenses | - | Rental expenses | - |

EBITDA | - | - | This will increase. |

Depreciation and amortization | Depreciation | - | Depreciation |

Profit before finance costs and income tax expenses | - | - | This will increase. |

Finance costs | Interest expenses related to lease contracts | - | Interest expenses related to lease liabilities |

- First-time application of TFRS 16

In terms of transition, TFRS 16 provides lessees with a choice between two methods to convert operating lease contracts into a lease liability and right-of-use asset:

1. Retrospectively to each prior period presented (“full retrospective method”) applying TAS 8 “Accounting Policies, Changes in Accounting Estimates and Errors”.

As a result, in the financial statements of lessees for 2020, companies would revise their 2018 and 2019 financial statements to reflect the recognition of lease contracts according to the new standard and record the cumulative effect of the change recognized in opening retained earnings as of 1 January 2018.

2. Retrospectively with the cumulative effect of initially applying the new leases standard recognized at the date of adoption (“modified retrospective method”).

In the financial statements of lessees for 2020, companies would not revise their 2018 or 2019 financial statements, but would record the cumulative effect of the change recognized in opening retained earnings as of 1 January 2020.

- Financial ratios

With the proposed changes in accounting for leases, application of this standard will impact financial ratios and performance metrics, such as the current ratio, asset turnover, return on equity, interest cover, EBITDA, EBIT, operating profit, net income, and operating cash flows. Relevant stakeholders will need to review and adjust to the new normal ratio ranges.

- Potential opportunities

- With the requirement that all leases must be recorded in the financial statements (except for exemptions noted above) companies will have the chance to more deeply analyse and assess lease data, review the lease objectives and economic benefits.

- Resultingly, companies should be able to develop, improve, and enhance processes and internal controls for lease accounting and lease reporting.

For more information, please visit the FAP website and the IASPLUS website.