Criteria for Defining ‘Related Legal Entity’

Keywords: Mazars, Thailand, Legal, Foreign Business Act, DBD, Ministry of Commerce, Ministerial Regulation

09 August 2019

In determining whether these unrestricted businesses are related-party transactions, the Department of Business Development, the Ministry of Commerce, has set out criteria for defining the term ‘related legal entity’ in the Ministerial Regulation setting out service businesses not subject to a foreign business licence (No. 4), 2562 B.E. (2019). The key criteria are as follows:

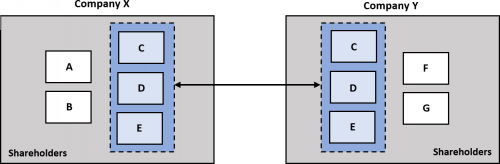

1. Number of shareholders and partners – More than half of the shareholders or partners in one legal entity make up more than half of the shareholders or partners of the other legal entity.

Example:

2. Percentage of capital

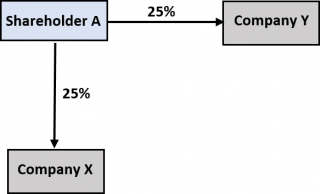

2.1 The shareholders or partners holding more than 25% of the value of the total capital of one legal entity are also shareholders or partners holding more than 25% of the value of the total capital of the other legal entity.

Example:

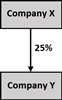

2.2 The legal entity is a shareholder or partner holding more than 25% of the value of the total capital of the other legal entity.

Example:

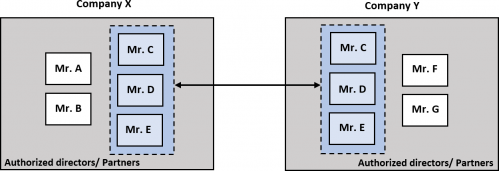

3. Management control – More than half of the directors or partners having management control over a legal entity make up more half of the number of directors or partners having management control over the other legal entity.

Example:

Reference: www.dbd.go.th