Hyperinflation in Turkey: IAS 29 on the agenda again

Keywords: Mazars, Thailand, IFRS, IAS 29,IAS 2, IPTF, CAQ, IFRIC 7

23 June 2022

Under IAS 29, preparers must restate the financial statements of an entity whose functional currency is the currency of a hyperinflationary economy. This rule takes effect from the opening of the reporting period in which the economy was first deemed to be hyperinflationary.

In the case of Turkey, IAS 29 thus applies from 1 January 2022 for entities whose reporting period coincides with the calendar year and whose functional currency is the Turkish lira. This applies to both the interim and annual financial statements. For other entities, financial statements should be restated in accordance with IAS 29 for any financial period including 1 April 2022.

Restating separate financial statements under IAS 29: a practical guide

Under IAS 29, entities are required to restate amounts in order to reflect the impacts of inflation by applying a general price index (GPI) to items in the financial statements that are not already expressed in terms of the measuring unit current at the end of the reporting period (thus excluding monetary items, i.e. money held and items to be received or paid in money). The standard does not specify which GPI should be used, but notes that all entities should use the same index. There is as yet no market consensus as to which GPI should be used for Turkey.

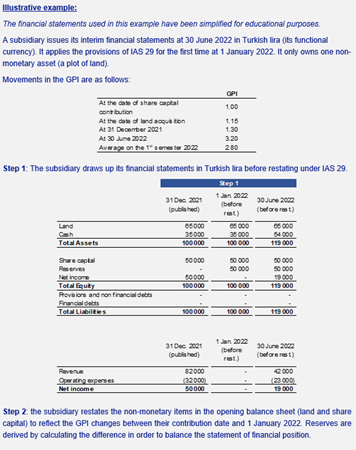

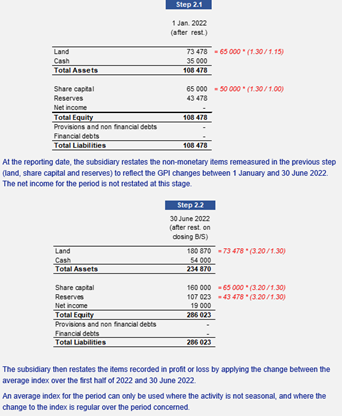

Thus, non-monetary assets and liabilities (such as inventories, property, plant and equipment, and intangible assets) should be restated at two different points in time:

- at the beginning of the reporting period, by applying the change in the GPI between the date of contribution and the start of the period at 1 January 2022 (including owners’ equity but excluding reserves, which are derived from all the other amounts);

- at the end of the reporting period, by applying the change in the GPI between the beginning of the reporting period (or the date of contribution, if this is later) and 30 June 2022 (including all components of equity except profit or loss).

The items in the statement of comprehensive income for the period (i.e. profit or loss and other comprehensive income) must also be restated by applying the change in the GPI since their date of initial recognition. Depreciation and changes in inventories shall be calculated in such a way as to take account of the effect of restatement in accordance with IAS 29 (as described above) on property, plant and equipment and inventories.

The gain or loss on the net monetary position, resulting from the restatements detailed above, is recognised in profit or loss and must be presented separately. As the restatement process is complex, it is important to carry out a consistency check to rationalize the sign of the gain or loss relative to the net monetary position.

Finally, IAS 29 will apply to separate financial statements drawn up to 31 December 2022 (with restatement of the opening balance sheet at 1 January 2022). This should make it easy to identify restatements under IAS 29 for the purposes of the IFRS consolidated financial statements.

Converting the subsidiary’s financial statements from the functional currency to the presentation currency of the IFRS consolidated financial statements

When establishing the IFRS consolidated financial statements, the separate financial statements (restated in accordance with IAS 29) must then be converted into the group’s presentation currency, if this differs from the entity’s functional currency. The closing rate method is used to do this. Here it is useful to refer to an IFRS IC agenda decision from September 2018 (which referred to the situation in Venezuela at the time, but the basic principles still apply). The decision specified how to determine the closing rate when a currency is subject to a long-term lack of exchangeability.

In accordance with IAS 21, the consolidated figures for comparative periods presented in a stable currency (such as the euro, US dollar or pound sterling) are not restated. The gain or loss on the net monetary position (as calculated at the entity level) is also presented in the consolidated financial statements. However, the IFRS standards do not specify exactly where in the income statement this gain or loss should be presented. In practice, it is often presented within the financial result.

Finally, an IFRS IC agenda decision in March 2020 confirmed that a preparer may choose where to present the effect of restating an entity’s non-monetary items and equity: either in reserves (i.e. directly in consolidated equity) or in other comprehensive income. The choice must be applied consistently over time and for all entities whose functional currency is the currency of a hyperinflationary economy. The decision should also be disclosed in the notes.

It should furthermore be noted that if the Turkish subsidiary is subsequently sold, the effect of IAS 29 restatements shall only be recycled to profit or loss if it was previously presented in other comprehensive income.

Other points to note

In addition to the impacts discussed above, first-time application of IAS 29 to the financial statements of Turkish subsidiaries could have the following effects:

- remeasurement of deferred tax (in accordance with IAS 12 and with reference to IFRIC 7 following the restatement of non-monetary assets, insofar as this increases the difference between the carrying amount of the assets and their tax base (depending on the relevant local legislation);

- an impairment review of restated non-current assets (including when there is no indication of an impairment loss).

In practice, applying IAS 29 requires significant use of judgement (many estimates required, reliability of available information, etc.). However, the standard states that “The consistent application of these procedures and judgements from period to period is more important than the precise accuracy of the resulting amounts included in the restated financial statements.”

For entities with significant investments in Turkey, it is important to start considering how to apply IAS 29 as soon as possible, so that all the impacts can be accurately reflected in the interim financial statements for 2022. The restatement process is complicated and will take time, as well as requiring significant input from local teams.

Even if the impact is not significant, it is important to carry out the calculations (in a simplified form if necessary) in order to be able to document this.

To help our readers implement IAS 29 in their consolidated interim financial statements for 2022, we present a simplified worked example on the following page.