Business combinations under common control

Keywords: Mazars, Thailand, IFRS, IASB, BCUCC, IFRS 3

29 March 2021

This is available here.

Readers will be aware that a DP is part of the research phase of the process, prior to the (potential) publication of an Exposure Draft (ED) and eventually of a new standard.

It should also be noted that a business combination under common control (BCUCC) is defined as “a business combination in which all of the combining entities or businesses are ultimately controlled by the same party or parties both before and after the business combination, and that control is not transitory” (IFRS 3.B1).

How are these transactions accounted for currently?

Business combinations under common control are excluded from the scope of IFRS 3, so in the absence of any specific guidance in IFRSs, companies must use their judgement to develop an accounting policy that will result in information that is relevant to users of financial statements (IAS 8.10).

In practice, these transactions are usually accounted for in the acquirer’s consolidated financial statements as follows:

- either using the acquisition method, as defined in IFRS 3, for acquisition of full control as described in that standard. This approach is based on the premise that a BCUCC is above all a business combination (and IAS 8.11 specifies that in the absence of a standard that specifically applies to a transaction, an entity may refer to existing standards that deal with related issues).

- or based on historical book values. This approach may be appropriate given that transactions between entities under common control are not always transactions under normal market conditions and are therefore not necessarily suitable for calculating fair value.

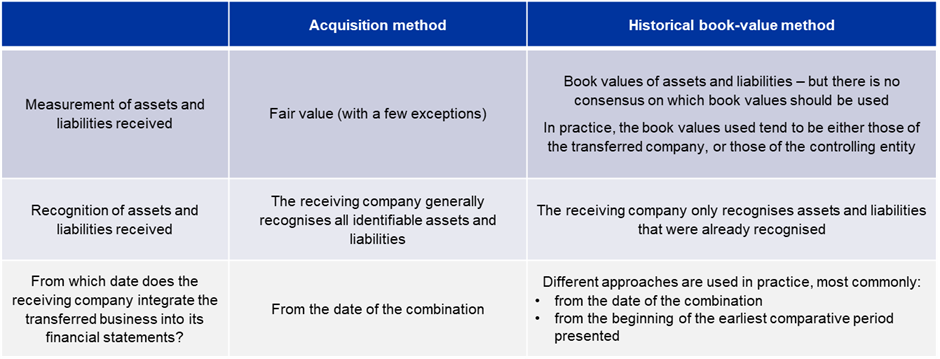

The table below shows the main differences between the two approaches in terms of the impacts on the financial statements.

The IASB’s objective for the DP is to reduce the (apparent) diversity in practice, to improve the transparency and comparability of financial information on these transactions, and to bring financial reporting more into line with the needs of users of financial statements.

What transactions fall within the scope of this project?

Although the project is called “Business Combinations under Common Control”, its scope is actually broader than this.

So-called “group restructurings” that do not meet the definition of a business combination set out in IFRS 3 – such as the transfer of a business to a newly established company – are also covered by the project.

The DP aims to specify the appropriate accounting treatment in the financial statements of the “receiving company” for all transfers of businesses (as defined in IFRS 3) in which all of the combining entities are controlled, both before and after, by the same controlling entity.

In contrast to the definition of BCUCCs given in IFRS 3, which specifies that control must not be transitory, the current project includes transactions in which:

- the transfer is preceded by an acquisition from a third party, or followed by the sale of one or more of the combining entities to a third party;

- the transfer is conditional on the sale of the combined entity to a third party, e.g. in the context of an initial public offering.

The DP also specifies that the term “receiving company” does not apply only to the immediate recipient of the transferred business, but also any parent companies (provided that they did not already control the transferred business).

The DP also notes that, since the controlling entity is already in a position to obtain all the information that it needs, the project focuses on the information requirements of (current and potential) non-controlling shareholders of the receiving company, as well as its lenders and creditors.

What measurement method should be used?

The differing stakeholder perspectives

In theory, diversity in practice could be reduced by applying a single approach to all business combinations, including business combinations under common control.

Some stakeholders favour the use of book values, emphasising that business combinations under common control differ from business combinations covered by IFRS 3 in that the former lack economic substance (as the controlling entity remains the same before and after the transaction).

Others hold that business combinations under common control are similar to business combinations covered by IFRS 3 in that both involve the transfer of a business. From the perspective of the immediate receiving company, the transaction has economic substance.

Still others argue that some business combinations under common control are similar to business combinations covered by IFRS 3, while others are different. They suggest that it is necessary to determine the extent to which a business combination under common control is similar to business combinations covered by IFRS 3. For example:

- do minority (non-controlling) shareholders hold a significant interest in the transferred business?

- is the price similar to the price that would have been paid if the transaction had involved a third party (unrelated to the entity)?

- how did the decision-making process work? What is the purpose of the transaction? Etc.

The IASB’s preliminary view

The IASB is of the view that not all business combinations under common control are different from business combinations covered by IFRS 3.

These transactions have economic substance for non-controlling shareholders in the receiving company, as well as for the controlling entity (if its ownership interest in the transferred business is reduced).

The Board acknowledges that the pricing of a transaction may differ from the price that would have been agreed with a third party, but felt that this should not affect the selection of the measurement method, only the way in which this method is applied in practice.

Finally, the general principle proposed by the Board at this stage is as follows:

- transactions that affect non-controlling shareholders of the receiving company should usually be accounted for using the acquisition method;

- conversely, transactions in which there are no non-controlling shareholders should be accounted for using a book-value method. This is partly because it can be difficult to identify the acquirer, and partly because it is not clear that the costs of applying the acquisition method would be justifiable.

In addition to these general principles, the Board has made the following further proposals:

- listed companies should use the acquisition method (as stock market regulations generally require a minimum free float);

- an unlisted company may apply the book-value method provided that non-controlling shareholders do not object (having been informed beforehand). This flexibility is similar to that already permitted under other IFRSs (e.g. the exemption from drawing up consolidated financial statements when certain criteria are met).

- an entity is required to use the book-value method if its non-controlling shareholders are related parties (as defined in IAS 24). This strict rule is primarily intended to reduce opportunities for accounting arbitrage (and also to reduce costs).

The IASB believes that this approach will reduce diversity in practice.

Firstly, the accounting method used would depend on the facts and circumstances of the specific transaction, and similar transactions would thus be accounted for in the same way.

Secondly, the rules would specify which book-value method should be applied, which would eliminate the diversity that currently results from the lack of a standardised procedure.

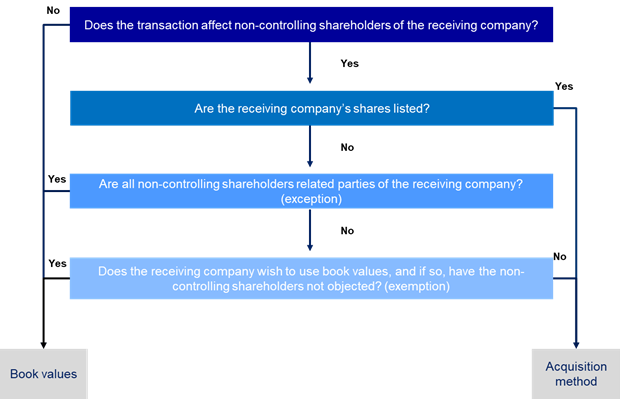

In practice: a visual explanation

The decision tree below shows the various questions that should be considered in order to determine which method should be used (book values or acquisition method - fair value) under the current proposals set out in the DP.

Applying the acquisition method

The IASB notes that the price paid by the receiving company may be influenced by the controlling entity, and thus may not correspond to the fair value of the transferred business.

The DP presents two possible situations:

The price paid is higher than the fair value of the transferred business: the excess is, in substance, a distribution to the controlling entity

The IASB’s provisional conclusion is that, in practice, the receiving entity should not be required to identify any excess.

The Board justifies this position as follows:

- such distributions are unlikely to occur, as there are usually legal constraints in place to protect the interests of non-controlling shareholders;

- any excess would be very difficult to measure;

- it would be recognised as an increase in goodwill (which could potentially be revised downwards again following impairment testing).

The price paid is lower than the fair value of the transferred business: the shortfall is, in substance, a contribution from the controlling entity

The IASB’s provisional conclusion is that, in practice, any resulting “badwill” should be recognised as a contribution to equity.

The Board justifies this position as follows:

- the situation is unlikely to occur (as it is not in the group’s interest to transfer wealth to the non-controlling shareholders of the receiving company);

- any shortfall would be very difficult to measure;

- it would be well-nigh impossible to distinguish between any shortfall (which should be recognised in equity) and “real” badwill (which should be recognised in profit or loss).

Applying the book-value method

Which book values should be used?

Until now, companies that have applied a book-value method to BCUCCs have generally used either:

- the book values reported by the transferred company (business); or

- the book values reported by the controlling entity.

Henceforth, according to the IASB’s provisional proposals, the transferred company’s book values should be used. This approach would make more sense conceptually, as the only parties to the transaction are the receiving company and the transferred business itself.

How should the acquisition price (i.e. the consideration paid) be measured?

Payment in the receiving company’s shares

In theory, when a receiving company pays for a transferred business using its own shares, the price paid can be measured either:

- at the book value of the issued shares; or

- at the fair value of the issued shares.

In practice, and given that the IASB is proposing that any difference between the price paid and the book value of the transferred assets and liabilities should be recognised in equity, the Board believes that it is not necessary to specify a rule for this (in any case, it only affects individual line items within equity).

Payment in assets

In theory, assets transferred by the receiving company could be measured either:

- at their book value (i.e. no gain or loss on disposal would be recognised); or

- at their fair value (which would probably have an impact on profit or loss).

The IASB argues that:

- using book values to measure any consideration paid in the form of transferred assets would be more consistent with the method used to measure the assets and liabilities received (which is also based on book values);

- information on any gain or loss on disposal would be of limited use to users of financial statements.

Thus, the IASB’s provisional view is that transferred assets should be measured at their book value.

What accounting treatment should be used for the difference between the price paid and the net assets received?

As noted above, the IASB believes that any difference between the price paid and the net value of assets and liabilities received should be recognised in equity.

The Board does not feel it is necessary to specify in which component of equity such differences should be recognised.

How should transaction costs be recorded?

The IASB proposes that the accounting treatment should be the same as under IFRS 3, i.e. transaction costs should be recognised as expenses. As with business combinations covered by IFRS 3, the costs of issuing shares or debt instruments should be accounted for in line with the general principles set out in IFRSs.

How should pre-combination information be presented?

Currently there is diversity in practice, so the Board had to consider whether the assets, liabilities, income and expenses of the transferred company should be combined:

- prospectively (i.e. from the date of the combination); or

- retrospectively (i.e. from the beginning of the earliest comparative period presented).

Some stakeholders argue that the second approach is preferable because there is, strictly speaking, no acquisition (the business remains within the same group) and the acquisition date is a fiction that is decided at a higher level. This argument is sometimes used to justify combining the information over all periods presented (obviously provided that the two entities have been under common control throughout these periods).

The IASB believes that a method based on historical book values is preferable as this is not dependent on how the combination is legally structured. Moreover, it avoids the difficulties involved in applying the acquisition method, notably identifying the “acquirer”.

This would suggest that it is preferable to restate the assets, liabilities, income and expenses of the transferred business for all periods presented.

However, some users of financial statements do not favour this retrospective approach, pointing out in particular that this is “pro forma” information (as the group including the transferred activity did not exist before the combination). The cost of a retrospective approach would likely be higher, and it would not affect the financial statements in the longer term (i.e. it would only affect the period in which the business combination occurs, and the comparative information presented in the following period).

Finally, the Board provisionally concluded that the assets, liabilities, income and expenses of the transferred business should only be combined from the date of the combination (i.e. prospectively), and there is no need to look beyond the legal structure to identify the “acquirer”.

What disclosures should be provided in the notes?

If the transaction is accounted for using the acquisition method, the disclosures required by IFRS 3 should be presented in the notes.

However, the IASB’s current position is that specific guidance should be developed to clarify how these requirements should be applied to business combinations under common control (covering the terms of the combination, whether an independent appraisal took place, and whether the transaction was approved by shareholders or the governing body of the receiving company).

For transactions accounted for using book values, the IASB considered the disclosure requirements of IFRS 3 as a starting point, but also took account of user needs and the cost/benefit trade-off when deciding on the required disclosures.

Its provisional conclusion is that any difference between the price paid and the book value of the transferred assets and liabilities should be disclosed in the notes, along with the affected component of equity.

The comment period for the IASB’s proposals is open until 1 September 2021.