M&A #1 Navigating through the reality of M&A

M&A #1 Navigating through the reality of M&A

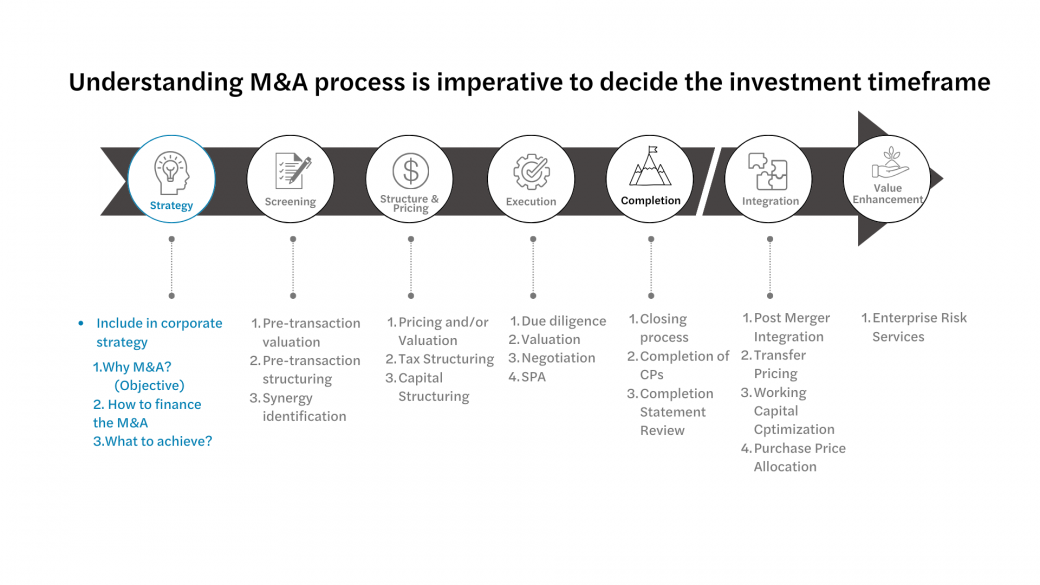

Think of the M&A journey like climbing a mountain. First, you must chart your journey (strategy), then scout the terrain (screening), decide on the best route and gear (structure & pricing), make the climb (execution), and finally reach the objective (completion).

But the adventure doesn't end there!

The next steps are integrating smoothly (especially in the first 100 days) and unlocking even more value (enhancement).

See the whole journey in the chart below:

M&A phases

Imagine buying a house without checking the inside of the house, the expected price, or without even having a plan for buying the house!

Similarly, planning is crucial in M&A, whether you're buying or selling a company.

The first step, strategy, is like laying the foundation of your M&A journey. Before you get swept away, ask yourself these three essential questions:

- Why M&A? Is it to conquer new markets, add new products or expertise, or something else? Make sure it fits your company's objective.

- How will you pay for this deal – cash, stock, or magic?

- What specific benefits do you expect from the M&A? Knowing your goals helps avoid post-deal surprises.

These questions are easy enough to answer without needing expertise in corporate finance or M&A. Answering these questions upfront sets you up for a smoother ride. Imagine a stress-free integration and investors cheering you on! Plus, a clear strategy makes your advisor your friend, guiding you efficiently.

Yes, it is good to be friends. Certainly, I can share insights into the stress levels experienced by advisors during M&A processes. So, be friends.

Let me explain the M&A phases with the example of Mr. Subho, a busy CEO of a family office whom I met a couple of years back. When he couldn't find a quality school for his daughter, he built his school.

Goal #1: Quality Education & Infrastructure

Starting with a kindergarten, Mr. Subho's school grew rapidly to a K-12 school, fuelled by the demand for excellent education in the city.

But Mr. Subho realized running a school wasn't his forte. His true passion lay in the world of manufacturing, in which he had expertise, and the manufacturing sector was booming during that time due to significant foreign investment in the country. ️

Goal #2: Time to Switch

Mr. Subho decided to exit the education business and cash out to invest in his preferred fields. He had answers for those three key questions:

Why M&A? (Strategy)

- Sell to the right fit: Mr. Subho wanted to sell his school, but not just to anyone. He was looking for a buyer who truly understood the education business and could build upon his legacy. It was important to him that the school’s reputation remained strong even after he was gone.

- Cash out completely: Sell 100% of the secondary shares. To offer ‘value of control’ to the buyer (expected to receive a premium).

- Reinvest wisely: Use the proceeds for investments aligned with market demand and his strengths.

Mr. Subho’s clear objectives greatly facilitated my role as his advisor and made my discussions with potential investors smooth. The most important thing for an M&A advisor, in my opinion, is to negotiate the best deal possible, all while fully understanding the client’s objectives and expectations.

The next discussion focuses on the screening phase.

Key points:

- Secondary shares are outstanding issued shares. For listed companies, secondary shares are the shares that are already traded on a stock exchange and being sold by existing shareholders.

- Cash-out means selling all the outstanding issued secondary shares to other investors for cash.