M&A #2 Navigating through the reality of M&A – the screening phase.

The first, and perhaps greatest, hurdle I have encountered when navigating deals in these markets is the limited options available to sellers seeking capital or an exit strategy. Back then, selling a business in Cambodia or Laos was like coming to a dead end. The only way out was finding a buyer (a trade sale), and prices weren't always ideal. And forget going public – that was a complete pipe dream. Thankfully, things are picking up speed! However, sellers in Thailand and Vietnam have a few more options for cashing out (but a trade sale is still preferred), and Cambodia is catching up slowly, with Laos to follow.

It has been observed over the years that buyers tend to focus solely on the price when there aren't many options on the table, overlooking the true value of the business. Limited choices for sellers often weaken their bargaining power. However, there are some deals where exceptional businesses command fair value, even in limited markets.

While sellers naturally value their businesses highly, sometimes their expectations might differ from reality, as sellers often think that the business will create huge value in the future. This creates an unbridgeable gap between the sellers’ value and the buyers’ price.

To bridge this gap effectively, it is important to work (as an M&A advisor) closely with clients (sellers) to understand their business potential, and expected achievable synergies and ensure their goals align with reality.

Advisors in these markets often use the word ‘valuation’ when they mean ‘pricing’ for companies involved in M&As (in most cases). However, they're not the same thing. Advisors suggesting a price range for similar deals mostly give an idea of the market price, not the company's true ‘value.’ They're helping guide negotiations, not declaring an absolute worth.

Even though people use ‘valuation’ a lot, it's important to understand the difference between that and ‘price’ in these situations. Both are important, but they have different meanings.

For example, I met an agent representing a thriving Laotian business a few years back. They shared their approach to valuing the company, considering the “average of last three years' earnings, and multiplying it by the average valuation multiples observed (transactions involving global Fortune 500 companies) in established markets like the US, UK, Spain, and France for similar industries”.

While their approach provided a starting point, it also sparked a valuable discussion about the appropriateness of valuing an asset/business and its applicability to emerging markets like Laos.

This way of doing M&A isn't right! It confuses people and gives them wrong ideas about price, value, and how M&A works. Because of this, it's harder for buyers and sellers to agree on a deal (In that Laotian deal, the buyers couldn't accept the approach taken by the seller’s advisor), and business owners might start to think M&A advisors aren't even helpful.

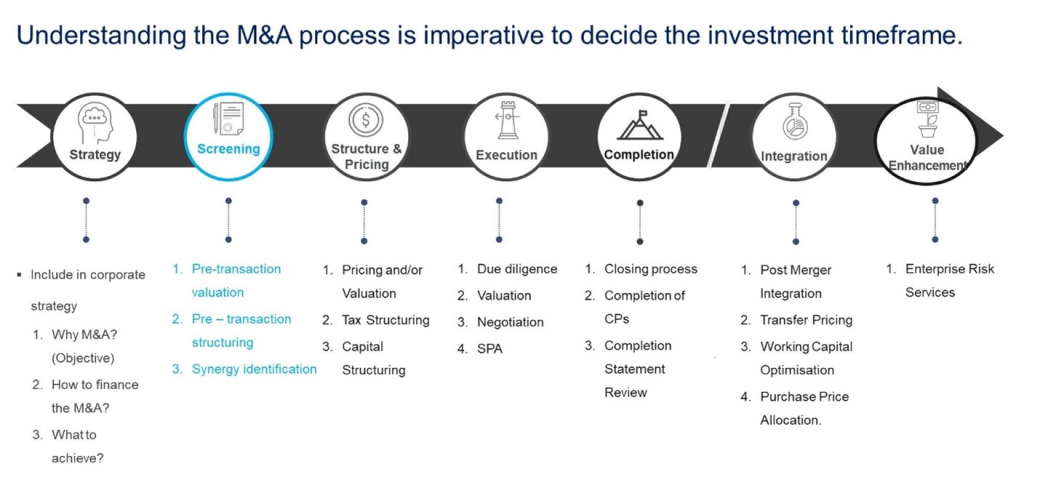

Overcoming these challenges begins with the critical screening phase of an M&A process. During this stage, an M&A advisor goes beyond guiding sellers on raising capital or exit strategies. They play a crucial role in demystifying the pricing and value of the business through clear explanations.

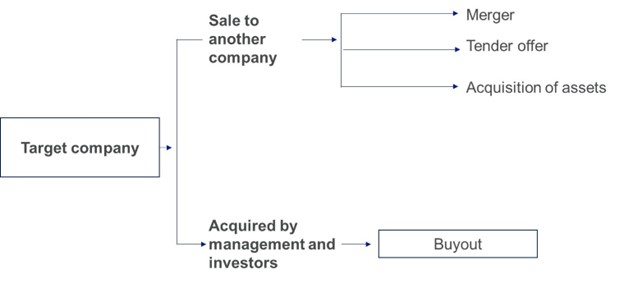

As we discussed regarding the sale of Mr. Subho’s schools (continuing from M&A#1), sellers typically have several exit options, which Mr. Subho was eager to understand.

- Merger: Exploring options for expansion, Mr. Subho considered merging his schools with established institutions in the city. However, the limited number of potential partners presented a significant challenge, as his school operated in a nascent market (‘frontier market’). The only existing international school occupied the premium segment, rendering a merger incongruous with Mr. Subho's mid-market positioning. Additionally, other potential partners were either non-profit entities or focused on bilingual education, further narrowing down the possibilities.

- Tender offer: Mr. Subho's intention to leverage a competitive bidding process for the 100% sale of his school business held promise. However, the execution faced obstacles due to specific market conditions at the time. Firstly, limited interest in the country by foreign investors restricted the pool of potential buyers. Secondly, the lack of local investors with sufficient capacity to acquire a school of this size further narrowed down the options. Furthermore, pursuing financial investors wasn't optimal for Mr. Subho, given their typical focus on acquiring partial stakes instead of complete ownership. This misalignment with his desire for a complete sale rendered them unsuitable candidates.

- Acquisition of assets: While the idea of the schools divesting themselves of individual assets presented possibilities, it ultimately emerged as an inappropriate approach for several compelling reasons:

- Valuation concerns: Selling assets piecemeal typically results in a lower overall value compared to selling the entire business as a going concern. The combined brand, established reputation, and operational synergies often contribute significantly to the premium attached to the sale of an entire business.

- Brand dilution: Dismantling the school and selling its assets would inevitably lead to the dissolution of the established brand and name. This could significantly impact the perceived value and marketability of individual assets, further reducing potential returns.

- Operational disruption: The process of selling assets often involves disruption to ongoing operations, potentially impacting students, staff, and the overall delivery of education. This could damage the school's reputation and make it even harder to attract buyers for the remaining assets.

- Limited buyer pool: Finding suitable buyers for individual assets like buildings, equipment, or intellectual property may be more challenging compared to seeking investors for the entire school business. This could lead to a drawn-out sale process and potentially less favourable terms.

Therefore, exploring alternative options, such as seeking strategic investors, considering a phased sale, or potentially waiting for improved market conditions were options that might have aligned more closely with Mr. Subho's goals of maximizing value and preserving the legacy of his schools.

4. Management buyout: While a management buyout (MBO) supported by an investor from the school's existing shareholder base presented itself as a potential option, it ultimately became apparent as an infeasible option due to several key factors:

- Leadership concerns: Although the current management held valuable operational experience, concerns emerged regarding their long-term vision and strategic capabilities. The specific industry demands a visionary leader able to navigate the evolving educational landscape and take the school forward. This potential shortcoming could compromise the success of the buyout and negatively affect investor confidence.

- Financing constraints: A crucial barrier was the scarcity of available acquisition financing in the frontier market at that particular time. This constrained lending environment significantly hampered the viability of the MBO, as securing adequate funds proved extremely challenging.

Common exit options

Following a thorough exploration of various exit options, a tender offer with strategic buyers emerged as the optimal strategy for Mr. Subho's school business. To ensure success, a year-long collaborative effort was made by me to:

1. Enhance operational and financial performance:

I worked closely with Mr. Subho to bolster the operational and financial health of the schools. This involved streamlining processes, improving efficiency, and strengthening financial reporting. These enhancements aimed to maximize the attractiveness of the business to potential buyers.

2. Bridging the valuation gap:

It was crucial to educate Mr. Subho on the nuances of pricing and valuation, clarifying the distinct differences between intrinsic value and market price. Additionally, I provided insights into the expected buyer's approach to the M&A process, ensuring Mr. Subho understood their evaluation criteria and long-term investment perspective.

3. Emphasizing synergistic value:

I gave Mr. Subho guidance on identifying potential synergies that his schools could offer potential buyers. This involved highlighting the resources and market reach that could enhance the combined entity's value proposition. By proactively showcasing these synergies, we aimed to increase the perceived value of his business for strategic buyers seeking long-term growth, not solely short-term profit maximization.

Overall, I firmly believe the screening phase lays the groundwork for a successful M&A transaction. As an advisor, we need to go beyond simply selecting the optimal exit option. An advisor’s role extends to educating and guiding clients on potential challenges, equipping them with the knowledge and understanding necessary to navigate the complexities of the deal. By adopting this comprehensive approach, we aimed to position Mr. Subho's school business for a successful tender offer with a strategic buyer, prioritizing long-term value creation over short-term gains.

Next, the structuring & pricing phase.